Bank of England base rate

A day after the US. The base rate dropped to an all time low of 01 following the outbreak of the coronavirus pandemic in March 2020.

The 5 000 Year History Of Interest Rates Shows Just How Historically Low Us Rates Are Right Now Gold Rate Interest Rates Low Interest Rate

This will affect the amount of interest you pay.

. This was the highest level in almost a decade. On 17 March the Bank of England BoE increased the bank rate from 050 to 075 marking the third successive rate hike. The base rate has changed to 075 Theres no need to call us well write to you if there are any changes to your payments as a result of the base rate increase on 17th March 2022.

The base rate is the interest rate the Bank of England charges on the money it lends to financial institutions like HSBC. The Base Rate is the interest rate set by the Bank of England and is also known as the official Bank Rate. Bank of England hikes base rate to 05.

The base rate was previously reduced to 01 on 19 March 2020 to help control the economic shock of coronavirus. The Bank of England BoE is the UKs central bank. Threadneedle Street London EC2R 8AH.

The bank reduced the base rate from 075 to 025 1 week earlier on 11 March 2020. 1 day agoLONDON The Bank of England is expected to opt for a fourth consecutive interest rate hike on Thursday but economists fear it is entering. The Bank of England will meet on 5 May to decide on the path of interest rates.

It was raised to 025 in December 2021 and again to 05 in February 2022. The Banks decision was driven by the desire to rein in surging inflationwhich was already at a multi. On 17 March 2022 the Bank of England announced a change in the Bank of England Base Rate from 05 to 075.

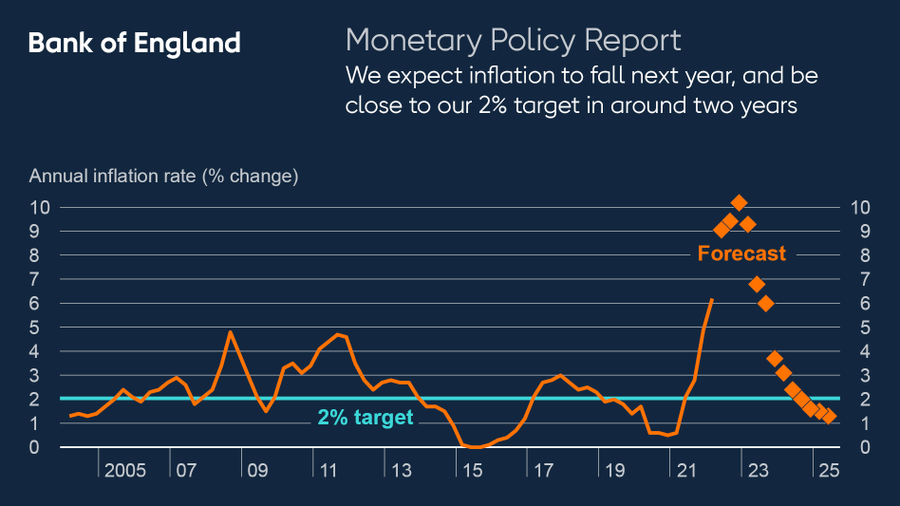

The rate of interest charged on these mortgages will be changed within 30 days of any change in the Bank of England base rate. Dates for Monetary Policy Committee MPC announcements on Bank Rate and publication of MPC meeting minutes and the quarterly Monetary Policy Report. 18 hours agoThe Bank of England has raised the base rate of interest to 1 - the fourth consecutive increase as it continues to move against surging inflation - despite issuing a warning about a recession ahead.

Federal Reserve raised its benchmark rate by half a percentage point - its biggest hike since 2000 - to a range of 075 to. Threadneedle Street London EC2R 8AH. It was cut twice in March 2020 to ease the economic pressure caused by the coronavirus pandemic from 075 to 025 on 11 March.

If the base rate changes the. The MPC meets eight times a year to set the. The increase means it is the third time in quick succession.

Bartholomew Lane London EC2R 8AH. Continue reading to find out more about how this could affect you. Well automatically recalculate the standard monthly payment and send you a letter or secure e-message to your Personal Online Banking account with the new amount.

The change means higher mortgage payments for more than two million. The base rate was increased from 025 to 050 on 3 February 2022 to try and control inflation. The MPC made the decision in response to CPI inflation rising to 54 a figure well above the Banks target of 2.

Daily spot rates against Sterling. Then in August 2018 the Bank of England raised the bank base rate from 05 to 075 as the economic outlook improved. The Bank of Englands Monetary Policy Committee MPC has voted by a slender majority of 5-4 to increase the base rate by 025 percentage points.

The Bank of Englands base interest rate is currently 075. In February when the MPC voted for a 025-point increase in the base rate she voted with a. The Bank of England finally raised interest rates in November 2017 for the first time in over a decade back to 05.

2 days agoThe Bank of England BoE base rate is often called the interest rate or Bank Rate and sets the level of interest all other banks charge. The base rate is used by the central bank to charge other banks and lenders when they borrow money and influences what borrowers pay and savers earn. The Bank of England base rate is currently 075.

Daily spot exchange rates against Sterling. 70 Current inflation rate Target 20. The Bank of England has increased base rates to 075 from 05 after the Monetary Policy Committee MPC voted in favour of a rise.

Moreover the Bank continues to wind down its asset purchasing program by no longer reinvesting maturing assets. The aim of the base rate reduction was to help control the economic impact of coronavirus on the UK economy. Bank of England Museum.

47 rows The Bank of England base rate is the UKs most influential interest rate and its official. Our mission is to deliver monetary and financial stability for the people of the United Kingdom. Interest is a fee you pay for borrowing money and is what banks pay you for.

The Bank of England BoE base rate which will be reviewed on Thursday May 5 impacts high street bank interest rates. The current Bank of England base rate is 075. 12 hours agoThe base rate is the interest rate that the Bank of England charges commercial banks for loans and until now stood at 075.

Our use of cookies. Bank of England Museum.

Pin On Numerology January 2020

Historical Interest Rates Uk Economics Help Interest Rates Economics Rate

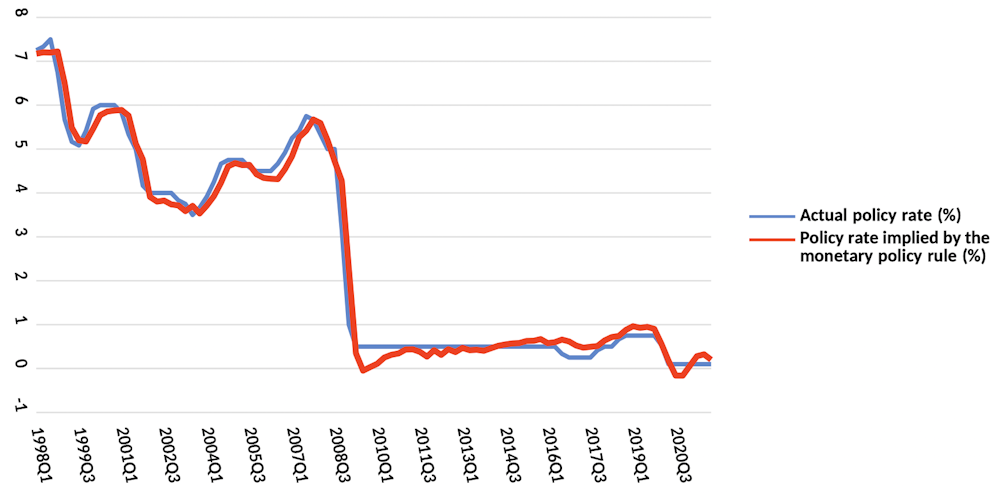

I Ve Fine Tuned A Tool That Advises The Bank Of England What Interest Rates To Set Here S What It Says

How The Bank Of England Set Interest Rates Economics Help

Traders Low Expectations For Boe Rate Stir Complacency Debate Debate Expectations How To Plan

Two Years And Counting Bank Of England Still Trying To Decode Labor Market Labour Market Bank Of England Decoding

Uk Housing Market Economics Help Mortgage Rates Bank Rate Mortgage Lenders

Uk Interest Rates Rise For First Time In 10 Years Interest Rate Chart Interest Rates Rate

How The Bank Of England Set Interest Rates Economics Help

Historical Interest Rates Uk Economics Help Interest Rates Economics Rate

Traders Bet U K Will Have Negative Interest Rates By Year End Bank Of England Interest Rate Swap Uk Banks